All Categories

Featured

Table of Contents

A PUAR allows you to "overfund" your insurance coverage right up to line of it becoming a Changed Endowment Agreement (MEC). When you use a PUAR, you swiftly raise your cash money value (and your death advantage), therefore boosting the power of your "bank". Further, the more cash money value you have, the greater your passion and returns settlements from your insurance provider will be.

With the surge of TikTok as an information-sharing platform, monetary guidance and approaches have found an unique means of spreading. One such method that has been making the rounds is the unlimited banking principle, or IBC for brief, gathering recommendations from celebrities like rap artist Waka Flocka Fire. While the technique is currently popular, its origins trace back to the 1980s when financial expert Nelson Nash introduced it to the globe.

What is the long-term impact of Infinite Banking For Financial Freedom on my financial plan?

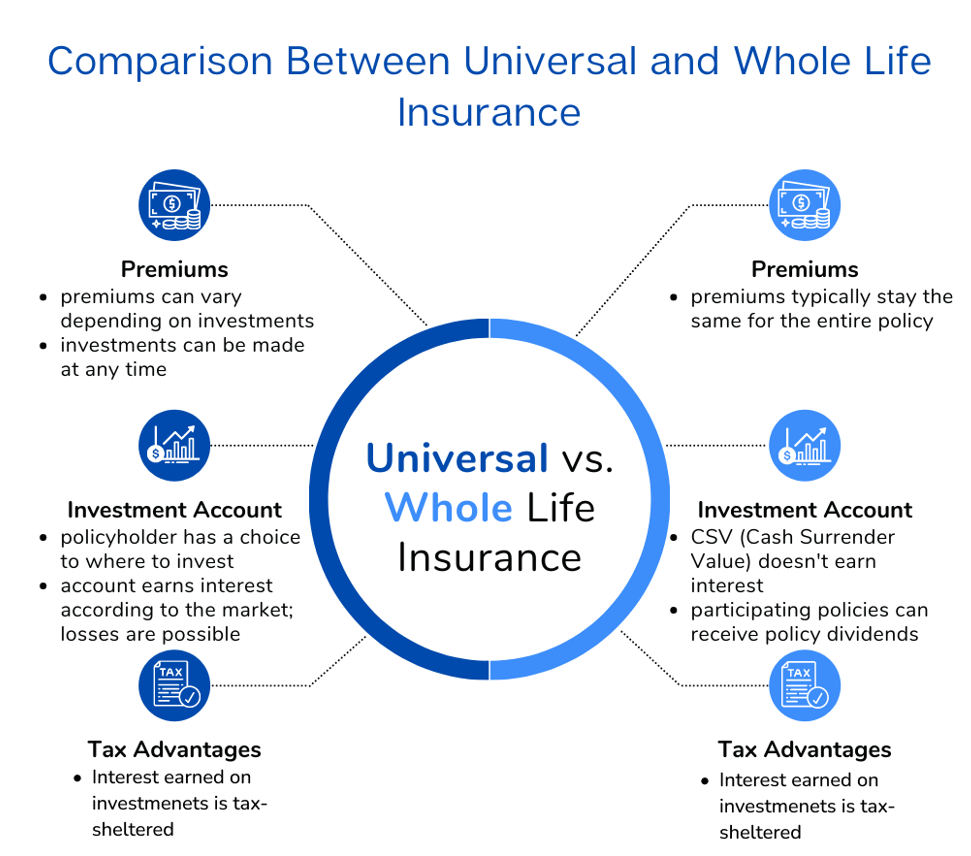

Within these policies, the money value expands based upon a price set by the insurance company (Life insurance loans). As soon as a significant cash money worth builds up, policyholders can get a cash value funding. These car loans differ from standard ones, with life insurance coverage functioning as collateral, indicating one might lose their insurance coverage if loaning excessively without ample cash worth to sustain the insurance policy costs

And while the appeal of these policies is evident, there are inherent limitations and dangers, necessitating persistent cash money worth monitoring. The strategy's authenticity isn't black and white. For high-net-worth people or local business owner, specifically those using techniques like company-owned life insurance policy (COLI), the advantages of tax obligation breaks and compound growth might be appealing.

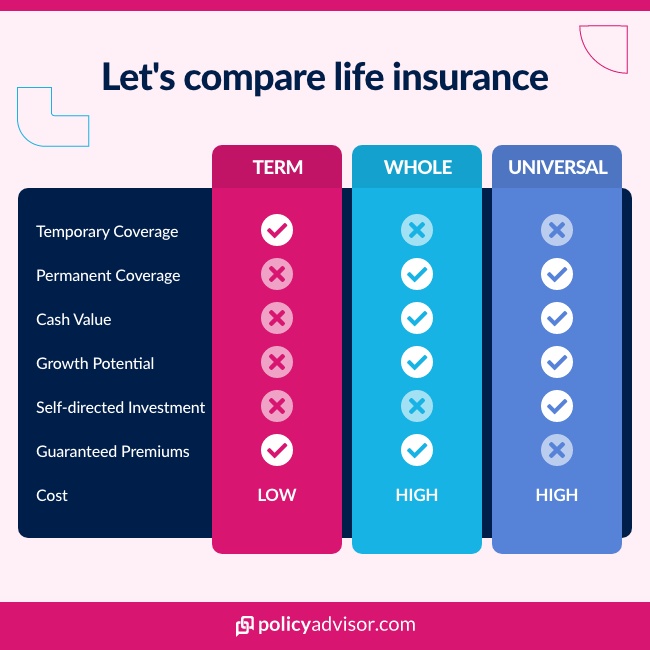

The allure of limitless banking does not negate its obstacles: Price: The fundamental requirement, an irreversible life insurance coverage policy, is costlier than its term counterparts. Qualification: Not everyone certifies for entire life insurance policy due to extensive underwriting processes that can omit those with specific wellness or lifestyle problems. Intricacy and risk: The complex nature of IBC, paired with its dangers, may prevent numerous, specifically when less complex and less high-risk options are readily available.

What are the risks of using Wealth Management With Infinite Banking?

Allocating around 10% of your month-to-month revenue to the plan is just not viable for many people. Component of what you read below is just a reiteration of what has actually currently been claimed above.

So prior to you obtain into a scenario you're not planned for, know the following first: Although the idea is typically sold thus, you're not really taking a lending from on your own. If that held true, you wouldn't have to settle it. Rather, you're obtaining from the insurer and have to repay it with interest.

Some social media articles advise making use of money value from whole life insurance policy to pay down credit score card debt. When you pay back the financing, a portion of that rate of interest goes to the insurance company.

For the initial numerous years, you'll be settling the commission. This makes it very tough for your policy to gather worth during this time. Whole life insurance policy costs 5 to 15 times more than term insurance. Lots of people merely can't manage it. So, unless you can afford to pay a few to numerous hundred dollars for the next decade or even more, IBC will not work for you.

What type of insurance policies work best with Infinite Banking For Financial Freedom?

Not every person should rely only on themselves for financial safety and security. If you need life insurance policy, right here are some valuable tips to think about: Think about term life insurance policy. These plans offer insurance coverage during years with substantial financial responsibilities, like home loans, trainee finances, or when caring for young kids. Ensure to go shopping around for the finest rate.

Visualize never ever needing to stress over bank lendings or high rate of interest prices again. What happens if you could obtain cash on your terms and build wealth concurrently? That's the power of infinite financial life insurance policy. By leveraging the cash money worth of whole life insurance policy IUL policies, you can expand your wealth and borrow money without relying upon conventional financial institutions.

There's no collection finance term, and you have the liberty to pick the payment schedule, which can be as leisurely as repaying the funding at the time of death. Infinite Banking. This versatility encompasses the servicing of the car loans, where you can decide for interest-only repayments, maintaining the financing balance level and workable

Holding money in an IUL dealt with account being credited rate of interest can commonly be much better than holding the cash on deposit at a bank.: You have actually always dreamed of opening your own pastry shop. You can borrow from your IUL plan to cover the preliminary costs of renting out a room, purchasing equipment, and working with personnel.

Can anyone benefit from Privatized Banking System?

Personal lendings can be acquired from conventional financial institutions and cooperative credit union. Here are some essential factors to take into consideration. Bank card can offer an adaptable method to obtain money for really temporary periods. Borrowing cash on a credit scores card is generally really pricey with yearly portion prices of interest (APR) frequently getting to 20% to 30% or even more a year.

Table of Contents

Latest Posts

Becoming Your Own Banker Nelson Nash Pdf

Cash Flow Banking Reviews

Bank Concept

More

Latest Posts

Becoming Your Own Banker Nelson Nash Pdf

Cash Flow Banking Reviews

Bank Concept